Introduction

A Specialized course for the skills development in the vibrant field of Accounts | Finance | Banking | Taxation. This training program is launched after a thorough survey in various industries. Completely Seperate training modules are designed for Fresher Candidates and Working Professionals. Our R&D team has designed a fully practical training module to cater the layman.

Course Name - Certified Course in Accounts & Taxation(CCAT) - Working Professionals

Eligibility - 12th Commerce & above

Certificate - NCVT(Govt. of India)

Admission Helpline - 7378378632/33 | roushan@eduskillsindia.com

Course Highlights

Tally Entries & Advance Practical Accounts

Accounts Finalization

Income Tax

Tax Deducted at Source - TDS

Goods & Services Tax - GST

Live Projects

100% Practical Training

Govt Form Filling and e-Filling process

Course delivery through experienced Chartered Accountants

Free Notes and Study Material

Fast track and Sunday Batches available on request

Placements to bright students

PART 1 - Direct Taxation

- Income Tax -:

Concept of Income Tax | Source of income | Five Heads of Income | Rate of Income Tax | Application Of PAN | Accounting Entries | Interest Computation | Advance Tax | Computation of Total Income | Deduction U/S 80C to 80U | Online Payment Process | E-filing Process | Class Assignment | ITR-1, Form 49A | ITR-4S, ITR-2A | Assignment Practice-1

- TDS

Concept of TDS | Applicability of TDS | Rate of TDS | Application TAN | Accounting Entries | Interest Computation | Online Payment Process | E-filing Process | Issue of TDS Certificate | Class Assignment | Concept of TCS | Form 49B, Form 26Q | Form16, Form 16A | Assignment Practice-1.

- Professional Tax:

: Concept of PT | Online Application of PT | Rate of Tax | Registration Process | Accounting Entries | Online Payment Process | E-filing Process | MTR-6, FORM- ( B ) | Class Assigment-1 | Assignment Practice-1

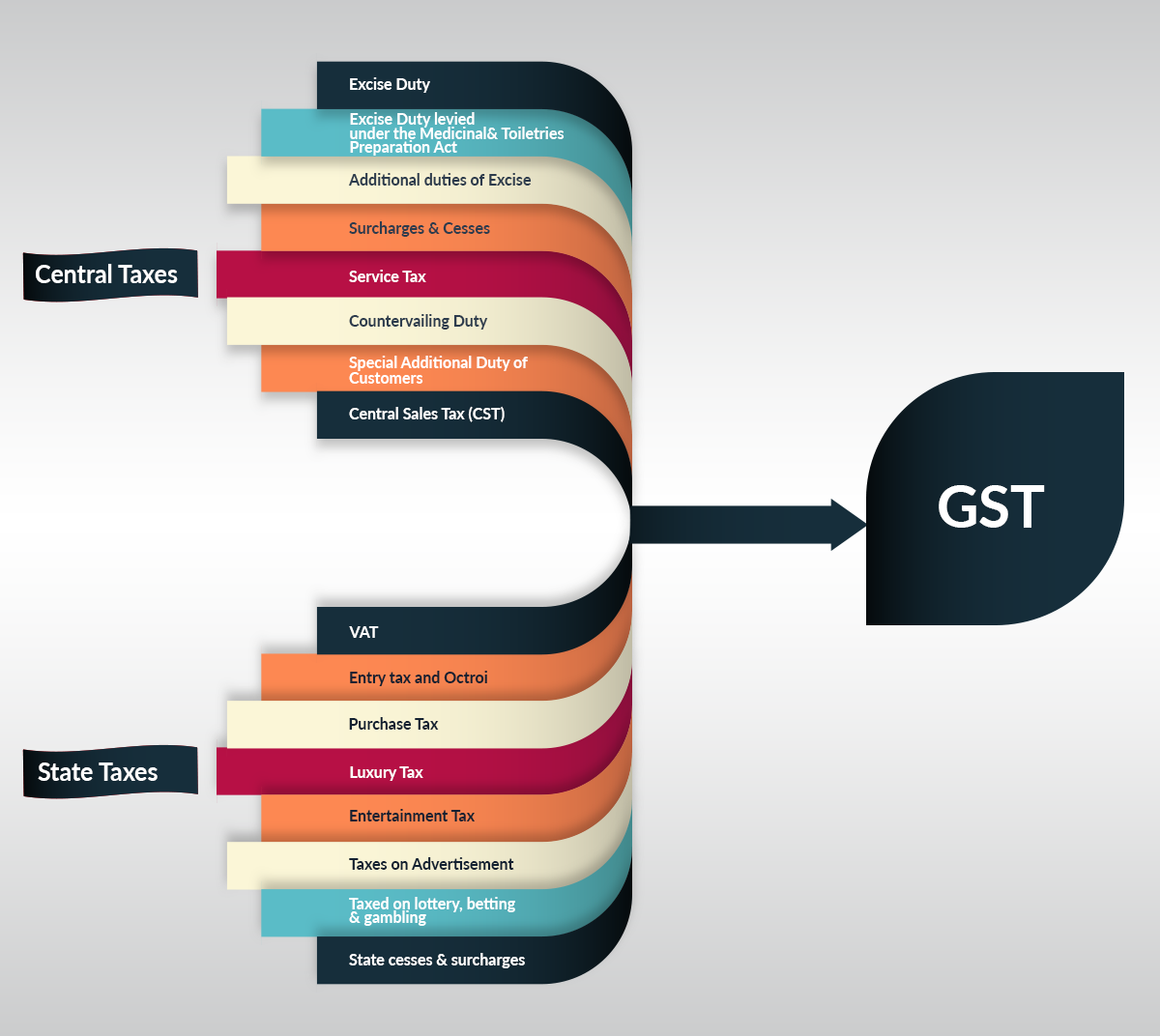

PART 2 - Goods & Services Tax (GST) - (Click Here for Detail Contents)

- Level I- BASIC:

Overview of Goods and Services Tax | Levy of an Exemption from Tax | Registration of GST | Meaning and Scope of Supply | Time of Supply | Valuation in GST | Payment of GST | Electronic Commerce | Input Tax Credit | Input Service Distributors | Matching of Input Tax Credit | Overview of the IGST Act | Place of Supply of Goods & Services | GST Portal

- Level II- EXPERT:

General Framework of GST | Registration | Returns in GST | Payment of GST | Refund | Input Tax, Output Tax And Credit Mechanism

PART 3 - Advanced Accounts & Finalization

- Advance Accounting :

: Concept of Advance Accounting | Finalization Process | Profit Screening | Advance Entries | Audit Adjustment Entries | Depreciation | Accounting Treatment | Cash Flow Statement | Ratio Analysis | Company Final Accounts | Assignment in Excel | Fixed Assets Register | Assignment Practice-1 | Schedule III

- Live Project :

Objective of Live Project | Practice of Live Project | Importance of Working Paper | Advance Entries | Audit Adjustment Entries | Depreciation Accounting | Assignment in Tally.